Minerva is an interface that has been built on the Etheruem Blockchain and its main aim is to help address mainstream cryptocurrency issues as well as provide partnered businesses with incentive payment solutions. Its primary token is Minerva OWL and ERC20 tokens. The company’s main aim is to provide highly efficient trading strategies to all their members to enable them to get good returns from their investments.

What is Minerva?

This is the first reverse Merchant processor in the world. The main purpose is to make use of crypto currencies in the mainstream. Today traders do not accept any crypto currency as a method of payment due to the high volatility in this currency market. To eliminate such risk, it is designed in such a way that when receiving payments via Token OWL traders will be paid back. Minerva does not charge transaction fees instead, it pays back for its use. This is the basic difference between traditional payment methods. So to say Smart Money is built on smart contracts on the Ethereal blocking network.

This is the first reverse Merchant processor in the world. The main purpose is to make use of crypto currencies in the mainstream. Today traders do not accept any crypto currency as a method of payment due to the high volatility in this currency market. To eliminate such risk, it is designed in such a way that when receiving payments via Token OWL traders will be paid back. Minerva does not charge transaction fees instead, it pays back for its use. This is the basic difference between traditional payment methods. So to say Smart Money is built on smart contracts on the Ethereal blocking network.How Minerva Is Different From Bitcoin?

This is a very common question that many people ask. Many people want to know if Minerva is different from Bitcoin, and if so, how? The main difference between Bitcoin and Minerva is that Minerva is actually designed to reward platforms that accept the token that it has designed (OWL tokens) with reversed transaction fees. In addition to that, Minerva also addresses common challenges of mainstream cryptocurrency adoption. In addition to being one of the leading cryptocurrency platforms, Minerva also takes pride for being the first reverse merchant processor in the world. Minerva is the interface, while the OWL token is its currency.

Advantages of MINERVA

New cryptocurrencies are introduced almost daily and their value can grow exponentially from the start. At the same time, many were abandoned after the novelty and market of the "honeymoon period", after which soon fell out of meaningful use. Despite this newborn market's cryptocurrency features, it is clear that some of the statistical properties of the cryptocurrency market have stabilized over the years. The number of active cryptoes, the distribution of market share, and the crypto diarrhea turnover remain predictable.

By adopting a mathematical perspective, we see a neutral model of the economy of cryptocurrency. This allows one to gather insights based on clear empirical observations, regardless of the advantages and disadvantages of one crypto above the other. We have used this research to uncover the unique nature and important factors for understanding how cryptococcus provides value to end users and long-term token holders.

Where Proceeds Generated From Token Crowdsale Will Go?

The proceeds generated from the crowdsale are divided in multiple fractions. 75% of the proceeds will be distributed to crowd sale participants. 10% of the remainder will be distributed to the founding members and advisors. 10% of the remainder will be reserved for other long term operational costs as well as new advancements that the company is planning to undertake in the future.

2.5% of the remainder will be reserved and will be distributed later when the company forms new partnerships in the aim of signing bonuses. The final 2.5% will be reserved and will be used by the company for their diligent bug bounty program. This means that the crypto assets that are transferred in exchange for OWL tokens will actually be revenue that the company will use.

Why Choose Minerva?

It Is The World’s First Reverse Merchant Processor

Minerva is actually the world’s first reserve merchant processer. What makes this company stand out is the fact that it pays transaction fees to various businesses without charging them even a single cent. The company does this because it wants to address the long term cryptocurrency problems that have halted the progress of this industry for a long period of time. In addition to that, it also plans to introduce commerce disruptive incentivized payment to help accelerate the adoption of smart contracts and cryptocurrency.

Model Distribution & Supply

Minerva uses two advanced methods to increase and decrease OWL token supplies. The first method mints a new Minerva OWL token and puts it into the economy when the partner platform receives the token as a payment method. The rate at which the current OWL token enters the economy is called the "rate of return". The rate of return is directly proportional to the OWL price: as the price increases, the rate of return rises. The reward rate will rise to increase the total supply sufficient to prevent a harsh short-run price swing. When the reward rate is greater than zero (0), a small portion of the prize is sent to the contract in which they can be exchanged for the MVP token (Minerva Benchmark Protocol tokens) and the polling token. The rate of inflation inherent rewards used to reward the platform is difficult to close by 10%. This hard cap means the supply will not change dramatically during significant growth episodes, allowing the market price to naturally stabilize when the artificial reflection is inadequate.

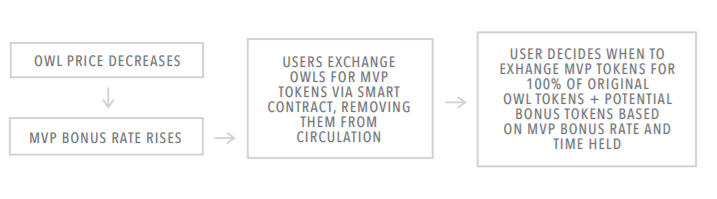

The second method sterilizes Minerva OWL tokens when the price falls. Instead of negative reward rates, we enforce systems that incentivize users to temporarily retrieve their OWL tokens from the economy. The user will exchange an OWL token for an MVP token representing certain OWL tokens that may (or may not) be appreciated over a specified period of time. In any case the price down of the MVP token will be sold, but the more drastically the price drops at the time of purchase, the higher the potential appreciation value of this token. This MVP proof will be exchanged at a later date for the original OWL tokens paid in addition to certain additional percentages. If there is a prolonged decline where MVP-prone funds are depleted, OWL tokens should naturally regain price stability.

Voting System

Voting is based on the Schelling point method inspired by Vituris Buterin's SchellingCoin, but modified to be more resistant to manipulation (described further below), to determine the approximate Minerva / USD conversion ratio. In addition to the normal transfer of OWL tokens, users will be able to use a function that enables the transfer of tokens and polls in a single transaction. Since this "piggybacking," voting will have a minimal gas cost (transaction fee). Instead of voting, voters will be given a certain number of polling tokens that are associated with their Minerva stocks that are deposited for voting.

Minerva uses four main methods to prevent voter manipulation:

- Deposits are required to choose; the deposit corresponds to the effect of the participant's vote on "Minerva contract price" and the deposit determines the prize received for voting. This deposit will be lost if the voting is considered invalid.

- A "votechain" is used in this process. Votechain allows further assessment of the validity of the past voice as new sounds are included. When a participant votes on the current price, they are also asked to enter the price of the last selected moment. These votes are then compared to previous polls and votes judged to be unlawful will lose their deposit. "Unauthorized sound" is defined as not falling between the 25th and 75th percentiles with sufficient sample sizes.

- If the votes are sufficient, all cast votes are rewarded, while at the same time only one percent is permitted to affect Minerva's contract price.

- Open source voting and polling automation with real-time log output as a failsafe mechanism. This safeguard is only activated if it is equipped with evidence of a sophisticated attack that occurs in the Minerva Volatility Protocol.

In addition to the above-mentioned voter manipulation checks, Minerva uses the following method, avoiding the Minerva Volatility Protocol token price manipulation:

- The time at which the new contract price begins to apply randomly so as to avoid the level of predictability that allows the manipulator to know the optimal time to buy an MVP token.

- Small fees apply when distributing the MVP token or the required hold time is set to prevent market activity that resembles speculative trading.

- The "MVP Door" applies where prices have to go down for a certain period of time before the ability to purchase an MVP token is available.

Immediate Use Case

The first business to be integrated into the Minerva economy is a live-streaming service with revenues of $ 20MM and over 10 million users. We will show you the impact of earnings before and after a clean and concise link with Minerva. At this time, Minerva has been advised to temporarily hold the name of our first business partner. We aim to integrate the various spectrum of major niche and mainstream businesses that cover multiple industries by recruiting platforms into the Smart Money Alliance (MSMA) Alliance.

Minerva will allow content creators to accept payments and exchange funds indiscriminately while allowing businesses to provide more value to customers and content creators alike.

Stability Guaranteed

One thing that many people are usually concerned with is whether the platform that they are joining is stable enough. Minerva is an interface that has been created from the Etheruem Blockchain that is highly efficient, secure, and reliable. The company has also put concrete measures in place to ensure that the stability of the platform is guaranteed. Minerva is a very strong platform that is here to stay. You can be sure that all your investments will be in safe hands.

Token Info

- 70% of sales and Final ICO

- 10% Founder

- 10% Long Term Operating Cost

- 5% Partner cooperation bonus

- 2.5% Bugs bug

- 2.5% of the ICO Grace Program

Minerva Final Words

Minerva has gone against all odds to create a reliable platform on the Etheruem Blockchain that addresses issues associated with mainstream cryptocurrency adoption. It also provides incentivized payment solutions to businesses that it has partnered with.

Roadmap

Contacts

The developers can be contacted using the link below:

ETH Address : 0x4be0D62Fc296136326F1A6BB6E3A543472c41820

0 Response to "Minerva – Smart Money Reverse Merchant Processor ICO? (ICO REVIEW)"

Post a Comment